Background

The pandemic has drastically shifted the housing market. Interest rates are at an all-time low and a record-breaking number of people are buying houses. As a result, bankers (team members that sell client’s mortgages) have pipelines in the 100s and are having trouble prioritizing how to follow up with their clients.

Liv SMS was created to provide our bankers a more efficient process to balance their existing pipeline, prospect new clients, identify when clients are no longer in the market, and call clients only when they need the banker’s expertise.

This project was a cross-team effort between Data Intelligence (my team), Business Strategy, and Strategy and Analytics. I served as the lead product designer and worked alongside engineers, another product designer, a business strategist, a data analyst, and banking leadership.

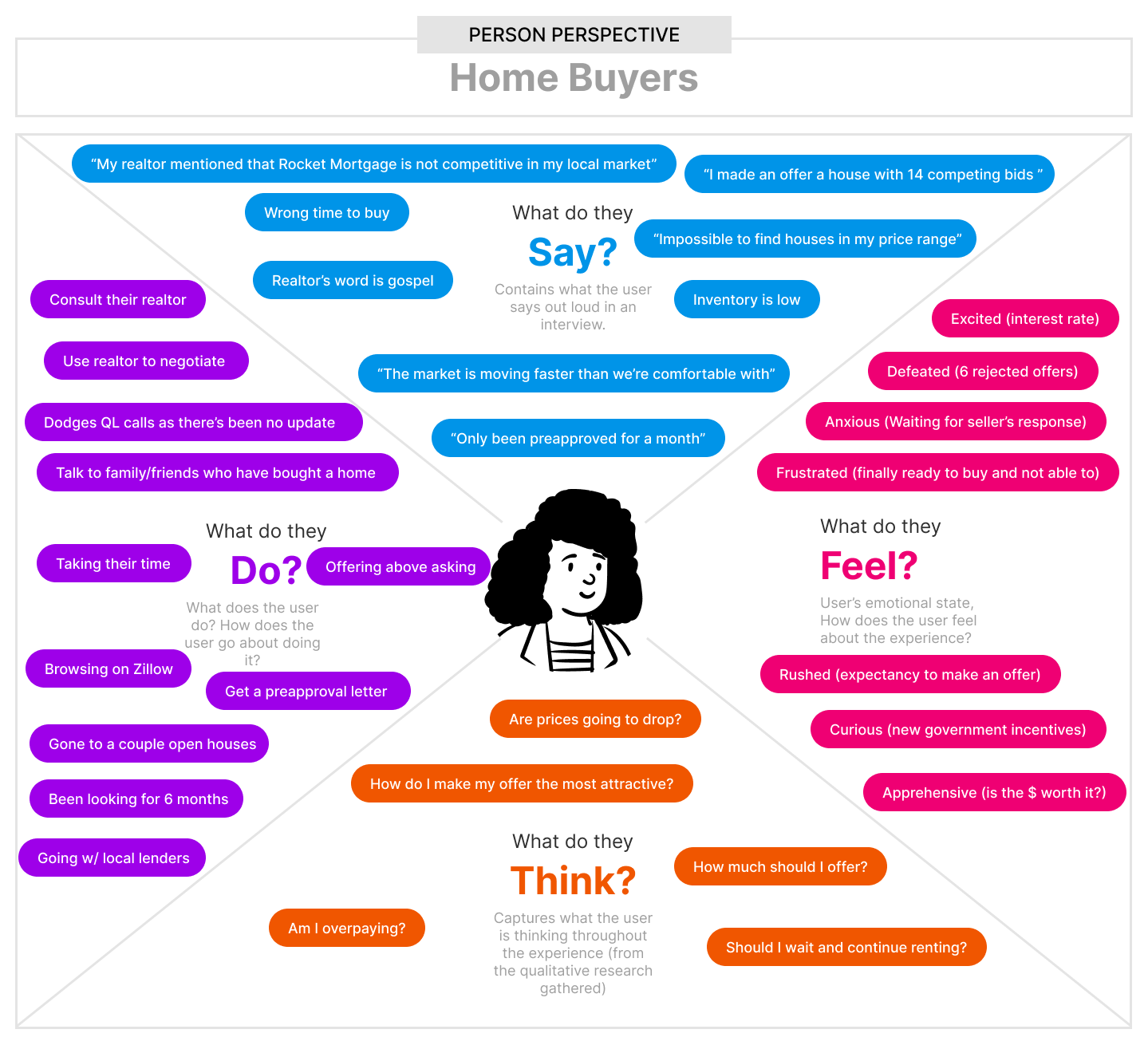

Initial Research.

Market research on other SMS bots on the market (an emphasis was placed on Fintech experiences including Digit, Albert, and Eno)

5 contextual inquiries were conducting with bankers.

Quantitative data of past SMS marketing campaigns were analyzed.

The following insights were identified:

Bankers work hard to build deep relationships with their clients. They do this to ensure that clients only want to work with them and thus are more likely to close with Quicken Loans.

Analyzing promotional text messages I found that texts that aren’t personalized with the banker's names have a response rate of 32.20% while texts that are personalized have a response rate of at least 51.81%

For a more in-depth look at my research click here.

Design.

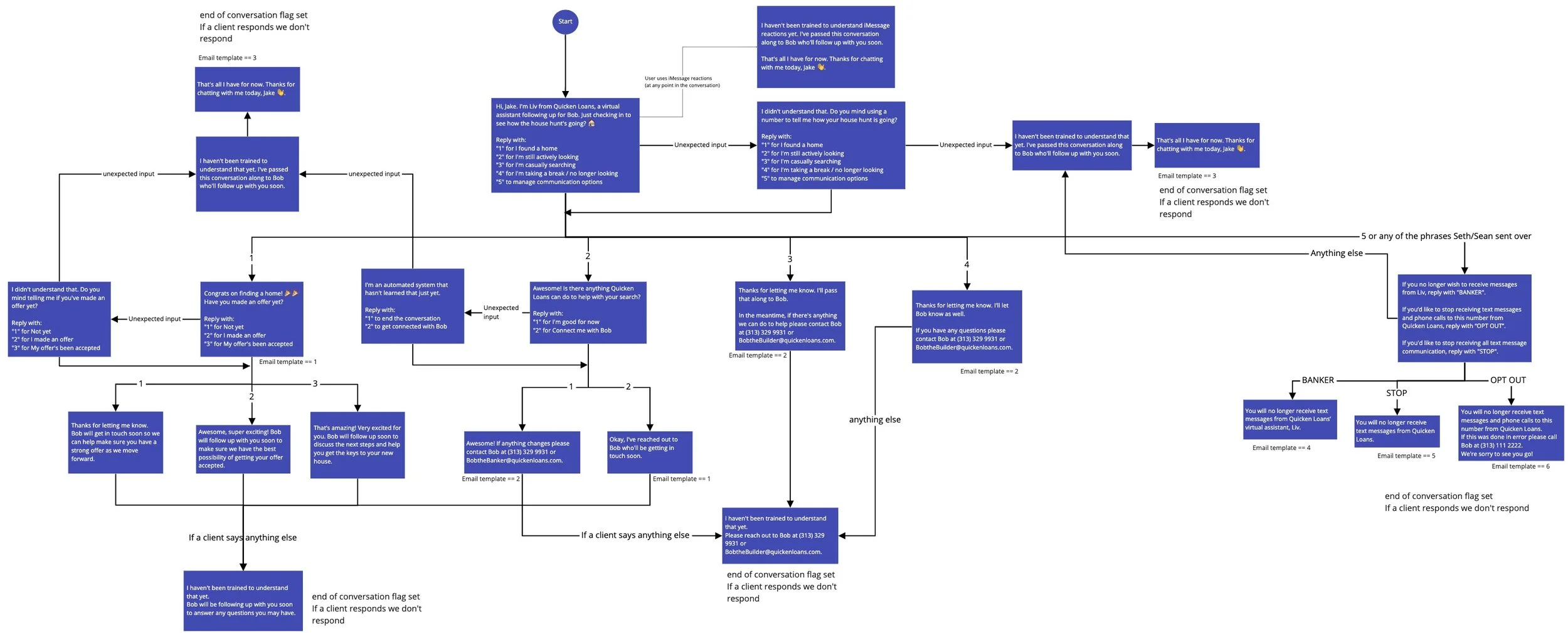

Content design for MVP

Conversation Design

Final look at the product

Results and Impact.

Our test group took on 359 more allocations than the control group. This means that Liv SMS allowed bankers to have even bigger pipelines than before. We also saw a much quicker turn around time from when a client got prequalified to when they closed on a mortgage. Our test group converted at 29.8% while the control group converted at 19.9%.

In the first 2 weeks of April 2021, 4,306 clients were eligible to be texted by Liv. 1,861 of the 4,306 texted clients responded to Liv – a 43.22% engagement rate.

Banker feedback

Raw feedback from bankers on how the pilot performed. I surveyed, interviewed, and watched bankers interact with the product to ensure we're able to make continuous improvements.

Reflection.

This is a project that I'm still supporting. This project taught me a lot about stakeholder management and collaboration and I credit the ultimate success of this pilot to bought in stakeholders.

Stakeholder management is not brought up super often in product design but I believe it's pivotal to the success of a product. This project really helped me improve my skills required to manage stakeholders and the various expectations they have. I spent weeks in meetings with our legal team and compliance teams and hours shadowing bankers to ensure this product made their jobs easier.